After peaking at $747.25/share, Google (GOOG) closed today at $508.95. It's been a sharp decline over the past few months, but its meteoric rise since its IPO was even more phenomenal. If you are a Google employee that's been around for, say, 2 years or even longer, you have vested shares that are worth real money. Secretly, you calculate your net worth more than a few times a week. "Holy Sh*t", you think to yourself, "I'm worth X millions of dollars, not even counting the unvested shares." You are quite pleased and you also rationalize the latest drop as only a temporary downturn. The stock price will jump back, you say to yourself. After all, Google *defines* the Internet. You work for the greatest company ever. Yet, maybe in the back of your mind, you are a bit concerned -- should you have sold some stock yesterday? That recent decline looks kinda like the last decline. And, even after a 30% decline, you are still in the money. "Might as well stick it out", you tell yourself. So, you continue to hold out -- selling nothing or only a small amount of your shares.

Maybe you exercised some options but did not sell -- holding out for potentially long term capital gain treatment on your

You are truly blessed. You've made a great choice to come work at Google. You've been rewarded handsomely. All those free meals, massages, and trips re-affirm your greatness. And, you are among the select few that get to define the future. It's all good, isn't it?

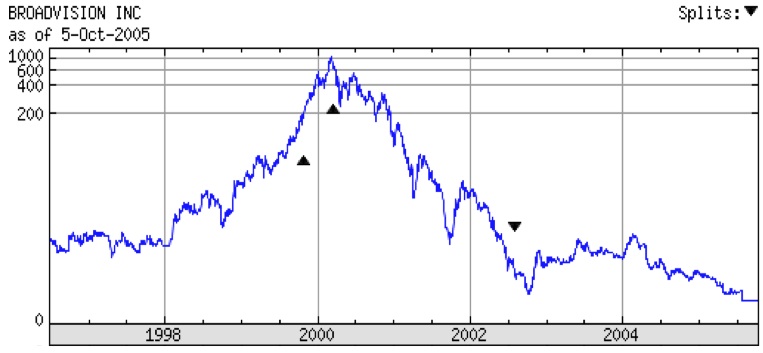

Maybe Google is truly a unique experience and the stock will rebound. It's kinda hard to tell. However, our past, the repeated boom-bust cycles in the Valley of yesteryears, says something different. Certainly, Google's success dwarfs the successes of most all other "booms." But, we've seen this pattern before:

Can we say with any certainty that the bust is not coming? For you, the happy Googler, I truly hope this is a temporary "correction" in stock price. However, I keep thinking that maybe you should take some money "off the table" and be rewarded for your efforts, just in case.

Post a comment